Cash-out Refinance Your Home For The Next Big Project

Just like there are so many different options for you to decide on that new kitchen backsplash, there are many ways you can fund your home renovation project. Home equity line of credit, a loan, or a cash-out refinance; there plenty to choose from. The concern though, is the right one for you? How about you cash-out refinance your home? Unlike a traditional refinance, where you simply replace the existing loan for a new one at a better interest rate; cash-out refinancing has you withdraw a portion of your home’s existing equity in a lump sum.

What is a Cash-Out Refinance?

This option available to homeowners is called a cash-out refinance. It gives homeowners the advantage of pulling equity that has been built up in their home from paying off their mortgage before the loan is completed. By withdrawing the differences between two mortgages in cash, homeowners can put money towards remodeling, building an addition, or even consolidating existing debts.

An example from Bankrate gives us this explanation, “Say you still owe $100,000 on your home and it’s now worth $300,000. Let’s assume that refinancing your current mortgage means you can get a lower interest rate, and you’ll use the cash to renovate your kitchen and bathrooms.

Lenders generally require you to maintain at least 20 percent equity — in this case, at least $60,000 —in your home after a cash-out refinance, so you’d be able to withdraw up to $140,000 in cash.”

Cash-out Refinancing Your Home Means You Still Owe On Your Mortgage

The basics of the cash-out refinance is this: you currently have an ongoing mortgage you are paying, you are requesting to borrow some of the home equity you have developed by paying into that mortgage and then refinance that borrowed amount back into your mortgage. For example: If your home is valued at $200,00 and you have paid a total of $100,000 into your mortgage – that means you have an available $100,000 in equity on your home. You can borrow some of this equity but banks will only allow funds for a certain amount (80% cap). If we assume that you are granted 80% of this equity for the cash-out refinance – you will get an $80,000 loan based on that equity for whatever you see fit. However, this is still a loan that was created from the equity you built throughout your mortgage. This 80k will be put back on to your existing mortgage thus increasing your mortgage to $180,000.

The Pros

There are benefits to utilizing a financing tool such as this for your next remodel or renovation. Homeowners can create a manageable monthly payment and see fixed rates from the refinance.

- Lower interest rate / monthly payment: If the timing of the market is good, performing a cash-out refinance can benefit you with a lower interest rate than your current one. This might even open up possibilities for lower monthly payments on your mortgage than before!

- Funds are used at your discretion: This cash-out is pulling from the equity you built within your home. That means you can use the funds however you see fit! This gives you flexibility for before and after your renovations and you don’t have to show proof.

- Fixed Rates: Cash-out refinances generally come with a fixed interest rate, this benefits a homeowner with payments that will not rise and fall with the index.

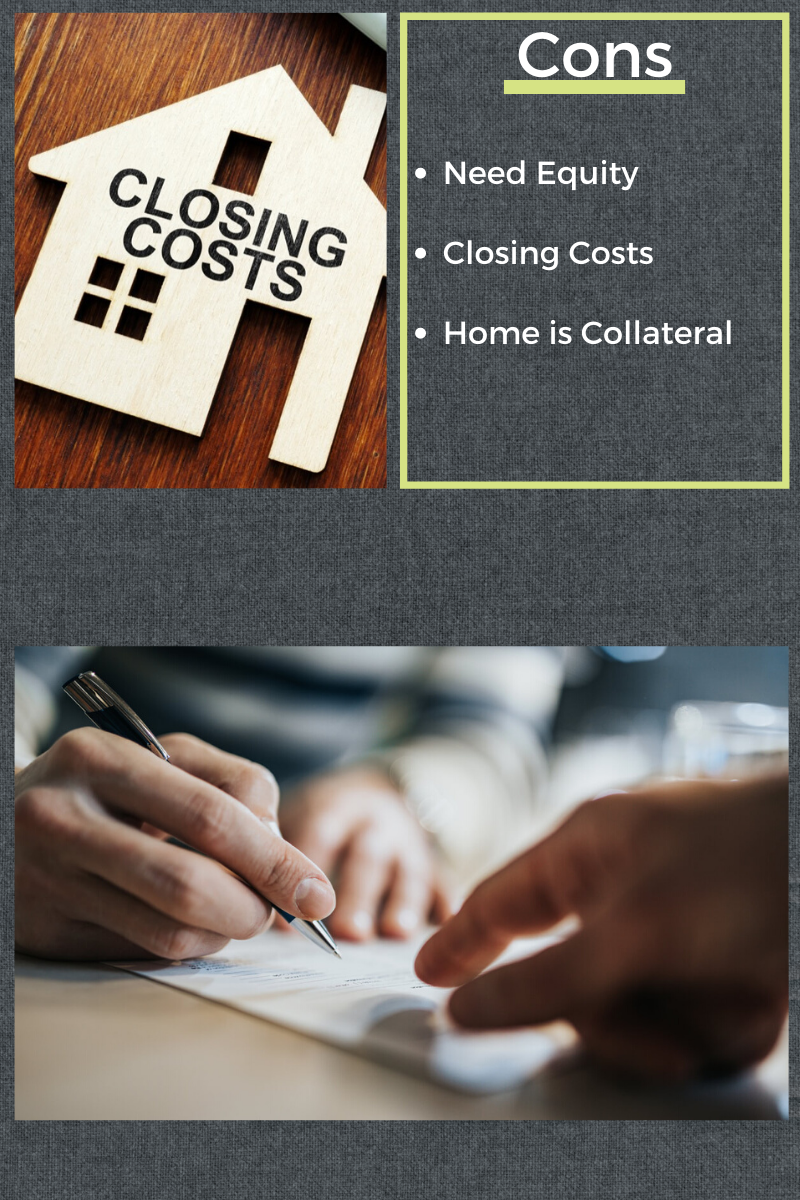

The Cons

- Must have home equity: You need to have built up some equity which ultimately means you need to have paid off your mortgage a fair amount.

- Closing Costs: When refinancing there will nearly always have closing costs associated with it. Anywhere 2-5% of the loan amount.

- It can be risky: Taking funds out by using your home as collateral is a standard procedure but that doesn’t mean it can’t have its risks.

Financing Your Home Remodel or Addition Has Multiple Solutions

Like we have stated earlier, there are many options and choices for someone to fund their remodeling, renovation, addition, basement finishing, etc. It might seem overwhelming at first but their professionals will gladly show you the best options suited for your needs. Sustainable Design Build even has some companies we partner with and trust to work with our clients, so if you would we would be happy to let you know who we work with. But the main takeaway is, no matter the project there is a way to fund it the most efficient way possible.

References

Frazer, Courtney. (Dec 16, 2019). How to Finance a Home Renovation. Interest.com. Retrieved from https://www.interest.com/mortgage/fha/finance-fixer-upper/

Wichter, Zach. (April 22, 2021). Cash-out mortgage refinancing: How it works and when it’s the right option. Bankrate. Retrieved from https://www.bankrate.com/mortgages/cash-out-refinancing/

Recent Comments