Finance home purchase and remodel with CHFA

The Colorado Housing and Finance Authority (CHFA) is a statewide network available to all residents of Colorado. CHFA helps Colorado residents to finance a home purchase and remodel. They sponsor financing assistance for home purchases, second mortgages, down payments, and closing cost assistance. The organization’s goal is to increase the availability of affordable, decent, and accessible housing for lower-income Coloradans.

Since Denver is currently in a short supply of homes for sale, some homeowners will find their purchased homes will need some work to bring it up to date. The CHFA offers 203(k) loans, which gives the ability to buy a home and renovate at the same time! Housing inventory is low so many people opt to buy a fixer-upper and make it their own. These projects can be anything like an unfinished basement, outdated kitchen or even constructing an addition or garage.

By fulfilling a small list of requirements anyone can be eligible for financial assistance provided by the CHFA.

Why does the CHFA Finance?

CHFA believes everybody should have the chance to become a responsible homeowner. To do so, CHFA invests in affordable housing and community developments. Also, they offer financial resources to those goals. As a result, 121,306 Colorado Homebuyers have achieved homeownership, 70,994 affordable rental housing units developed or preserved and 6,505 local businesses have accessible capital to support 72,699 jobs. So what can the CHFA do for you specifically as a prospective homebuyer?

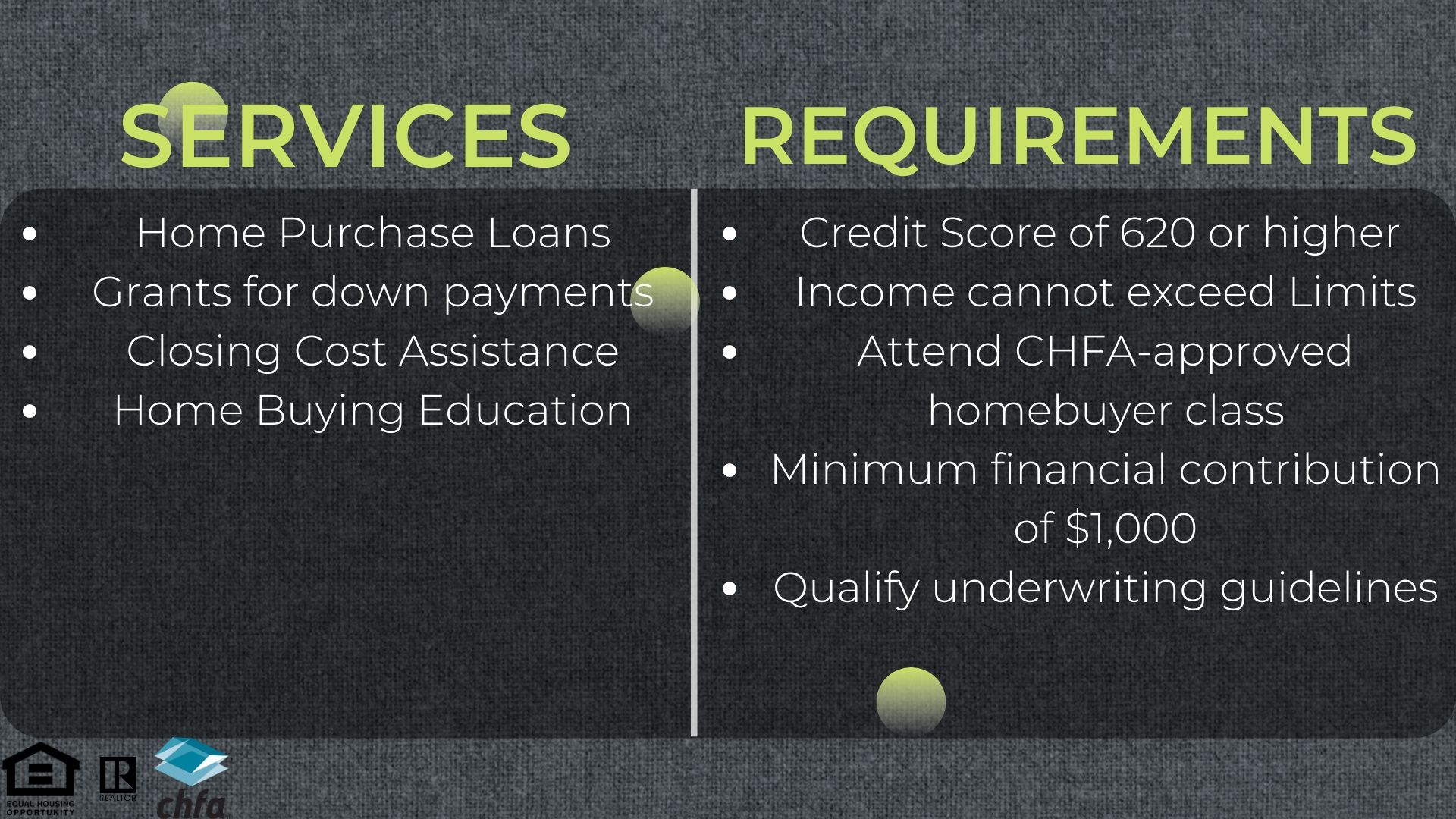

- Home Purchase Loan Programs

- Grants and Second Mortgage loans for down payments

- Closing Cost Assistance

The Colorado Housing and Finance Authority

The Colorado Housing and Finance Authority (CHFA) is a statewide network available to all residents of Colorado. CHFA helps Colorado residents with financial assistance programs to buy and remodel homes. They sponsor financing assistance for home purchases, second mortgages, down payments, and closing cost assistance. The organization’s goal is to increase the availability of affordable, decent, and accessible housing for lower-income Coloradans.

Since Denver is currently in a short supply of homes for sale, some homeowners will find their purchased homes will need some work to bring it up to date. The CHFA offers 203(k) loans, which gives the ability to buy a home and renovate at the same time! Housing inventory is low so many people opt to buy a fixer-upper and make it their own. These projects can be anything like an unfinished basement, outdated kitchen or even constructing an addition or garage. This creates a versatile option for affordability and customization that homeowners can use to ensure they are funded for not only their home purchase but also its remodel.

By fulfilling a small list of requirements anyone can be eligible for financial assistance provided by the CHFA.

What does the CHFA offer?

CHFA believes everybody is entitled to the chance to become a responsible homeowner. To do so, CHFA invests in affordable housing and community developments. Additionally, they offer financial resources to those goals. As a result, 121,306 Colorado Homebuyers have achieved homeownership, 70,994 affordable rental housing units have been developed or preserved and 6,505 local businesses have accessible capital to support 72,699 jobs. So what can the CHFA do for you specifically as a prospective homebuyer?

- Home Purchase Loan Programs

- Grants and Second Mortgage loans for down payments

- Closing Cost Assistance

What are the general program requirements?

The CHFA commits to providing these program benefits to those who qualify, they also make sure that these requirements are attainable and realistic. Such requirements also include income limitations based on each Colorado County’s median income, for example, Denver County’s limit is $74,200.00

- Must have a credit score of 620 or higher

- Total income must not exceed CHFA’s Income Limits

- Attend a CHFA-approved homebuyer education class

- Make a minimum financial contribution of at least $1,000 toward the purchase of the home

- Additionally, the borrower must qualify for the underwriting guidelines as determined by one of CHFA’s Participating Lenders.

If you meet all of these requirements then you are able to begin the process by contacting a CHFA Participating Lender. But don’t forget that you will need a real estate agent to represent you through the buying process. Also, oftentimes, your real estate agent will be able to refer to their preferred lender who may be CHFA approved. If not you will need to source the lender by yourself which can be found through the CHFA websites network map.

What is Homebuyer Education?

Additionally, there is a requirement for education on becoming a homeowner. Applicants do need these classes immediately but you will have to attend an approved education classes before you close on any property. Luckily, CHFA offers these classes both online and in a classroom. The classes will be a requirement before the underwriting begins, so be sure to allow yourself the appropriate amount of time to register for a class during your house search.

Homebuyer education gives a helpful course in all the responsibilities of homeownership and how to finance or budget for a home purchase and remodel. The class will instruct on the homebuying process, including budgeting for successful loan approval. This is also helpful in understanding what your buying needs are like if you are planning to remodel, renovate or add to the home and need financing for it.

How do I Start the Process?

Simply go over to the CHFA website and select Contact a CHFA Participating Lender. These programs are available statewide and the network the CHFA has established is well built out. If you already have a lender in mind, you could ask them to see if they are a participating member of the program. The lender will review your financials and requirements and determine which CHFA loan program works for you. Not only that, after you are pre-approved they will work with throughout the entire loan process from application to closing.

This is a wonderful program that offers immense value to anyone who is considering purchasing property for their home or business but lacks certain qualifying credentials by themselves.

From there be sure to reach out and have a real estate agent to represent you through the buying process. They will take you to tour homes that fit the approved budget decided by your CHFA Lender. If you find the right home for you and it needs some updates, be sure to discuss with your CHFA lender about including those renovation costs into the loan so you can be fully funded for your new home!

Recent Comments